How New Technology Will Disrupt The Oil And Gas Industry

At a particular level in its lifecycle, each marketplace faces its instant of reckoning with increasing stress to transform thanks to variables this sort of as growing competitiveness, altering customer preferences, governing administration policy and other secular headwinds. The transformation normally will take the condition of improved source chain willpower as properly as streamlining company operations in buy to attain greater working margins.

For the oil and pure fuel industry, the second of real truth arrived a few years in the past soon after several years of weak benchmark charges, shrinking margins and large capital flight forced the sector to critically rethink the way it does business with power companies more and more turning towards tech heavyweights for assistance in cutting expenses and streamlining functions.

A very good situation in point is a partnership struck between Haliburton Co. (NYSE:HAL), Microsoft Inc. (NASDAQ:MSFT) and Accenture Plc. (NYSE:ACN) in 2020. For yrs, Haliburton, one particular of the world’s largest oilfield companies firms, has been plagued by shrinking margins and serious underperformance. The organization sooner or later made a offer with the two cloud giants to migrate its existing knowledge facilities to cloud and greatly enhance electronic choices.

Major discounts

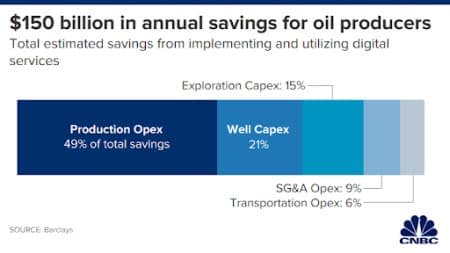

Resource: CNBC

Halliburton is hardly alone.

Right after many years of dilly-dallying, oil and gasoline corporations are now fast relocating their IT infrastructure out to the Cloud as effectively as adopting Business enterprise System Administration (BPM) programs. This frequently effects in a leaner, far more agile organizational product although providing sizeable cost savings.

Barclays estimates that the upstream sector digital expert services sector will mature from fewer than $5 billion in 2020 to a far more than $30 billion yearly tab by 2025, as a result enabling $150 billion in annual discounts for oil producers. Prospects for charge price savings incorporate slicing capital expenses (capex) as properly as selling, normal and administrative (SG&A) expenses and transportation working expenses.

In accordance to Barclays, the digital age is lastly dawning for the strength sector with the market place poised to erupt in excess of the following five decades. More than the past couple decades, Microsoft has struck cloud partnerships with many Major Oil providers including ExxonMobil (NYSE:XOM), Chevron Inc. (NYSE:CVX) and Haliburton even though Google’s father or mother company Alphabet Inc. (NASDAQ:GOOG) has noticeably expanded its partnership with Schlumberger Ltd. (NYSE:SLB), yet another oilfield products and services big. Meanwhile, Amazon Inc. (NASDAQ:AMZN) presents electronic solutions to the industry by way of Amazon Website Companies oil and gas division, and counts BP Plc. (NYSE:BP) and Shell Plc (NYSE:SHEL) between its major clientele.

In a lot of circumstances, Major Oil’s electronic makeover is quite extensive.

For instance, Halliburton kicked off many electronic transformation jobs in the course of the pandemic. Thailand’s PTT Exploration and Generation and Kuwait Oil Business ended up among the notable oil and gasoline firms that ended up awarded Halliburton contracts to put into action digital transformation and enhance performance and creation at their oilfields.

For many years, Significant Oil has been using tech companies’ organization software in their hugely elaborate running systems–including rig management functions and precise drilling techniques. However, they have customarily been somewhat reluctant to hand above their treasure troves of useful facts predominantly on cyber security issues as perfectly as the need to have to keep aggressive benefits, preferring alternatively to produce most of their software package designed in-home or by corporations within just the oilfield companies sector these kinds of as Haliburton.

Even so, this is now modifying as they appear for techniques to boost operational efficiencies in a bid to squeeze higher dollars flows and gains from their current operations.

Is the new approach working? The proof seems to suggest so, with shale drilling expenses on an encouraging downtrend. J.P. Morgan estimates that Permian’s Delaware Basin oil drillers now have to have oil charges of just ~$33/bbl to break even down from $40/bbl in 2019.

Artificial Intelligence (AI)

Let us experience it: Our electrical grids are basically sick-suited for the vitality shift. After all, renewable electricity is hugely intermittent by mother nature whilst our grids are built for near-continual electric power input/output. In fact, wind and photo voltaic vitality have the lowest ability factors of any energy source.

For the energy changeover to be effective, our power grids have to turn out to be a whole lot smarter. The good news is, there’s an encouraging precedent.

Five decades ago, Google announced that it experienced reached 100{60d48124524c163d93bcaf9d238c122260f539381ea62c0bffb11c8cd8c23591} renewable vitality for its world wide operations together with its information facilities and offices. Now, Google is the biggest corporate customer of renewable electrical power, with commitments totalling 2.6 gigawatts (2,600 megawatts) of wind and solar vitality.

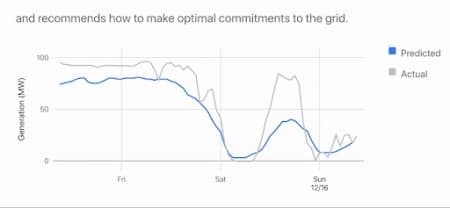

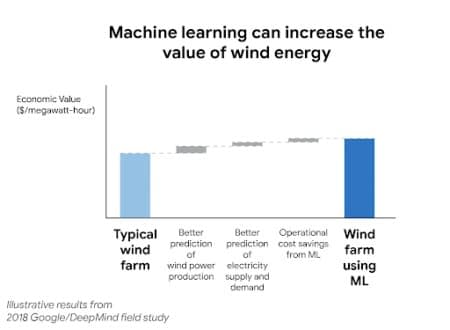

In 2017, Google teamed up with IBM to look for for a answer to the extremely intermittent character of wind power. Using IBM’s DeepMind AI system, Google deployed ML algorithms to 700 megawatts of wind electricity capability in the central United States–adequate to electrical power a medium-sized city.

IBM states that by employing a neural community experienced on widely offered climate forecasts and historic turbine details, DeepMind is now able to forecast wind electrical power output 36 hrs ahead of actual technology. For that reason, this has boosted the benefit of Google’s wind electricity by around 20 percent.

A similar model can be employed by other wind farm operators to make smarter, quicker and much more knowledge-pushed optimizations of their electricity output to improved meet consumer demand from customers.

IBM’s DeepMind utilizes skilled neural networks to forecast wind electricity output 36 hours ahead of true era

Supply: DeepMind

Houston, Texas-based Innowatts, is a startup that has created an automatic toolkit for energy checking and administration. The company’s eUtility platform ingests info from more than 34 million intelligent power meters across 21 million clients which includes main U.S. utility companies this sort of as Arizona Public Company Electric powered, Portland Standard Electric, Avangrid, Gexa Vitality, WGL, and Mega Power. Innowatts claims its device discovering algorithms are capable to examine the knowledge to forecast a number of critical information factors such as small- and prolonged-term hundreds, variances, climate sensitivity, and additional. Innowatts estimates that without the need of its device studying products, utilities would have witnessed inaccuracies of 20{60d48124524c163d93bcaf9d238c122260f539381ea62c0bffb11c8cd8c23591} or extra on their projections at the peak of the disaster consequently putting huge pressure on their operations and ultimately driving up charges for conclusion-users.

Additional, AI and electronic solutions can be employed to make our grids safer.3 a long time ago, California’s largest utility, Pacific Fuel & Electric powered, found alone in deep issues after becoming found culpable for the tragic 2018 wildfire accident that still left 84 persons lifeless and, as a result, was slapped with significant penalties of $13.5 billion as compensation to people today who shed houses and companies and one more $2 billion great by the California General public Utilities Commission for carelessness. Potentially the reduction of lives and livelihood could have been averted if PG&E experienced invested in some AI-driven early detection system like Innowats.By using electronic and AI versions, our ability grids will develop into ever more smarter and far more dependable and make the shift to renewable power smoother.

Blockchain

Even with its tremendous probable to change the world-wide electrical power sector, blockchain engineering has largely remained confined to the money sector with the energy marketplace continually catalyzed by innovations in sub-sectors these kinds of as rooftop photo voltaic, offshore wind, good metering, battery storage, and electric cars.

But this is now commencing to transform thanks to the Company Ethereum blockchain rising as the most recent technology to spur advancement in the vitality sector throughout a raft of verticals from peer-to-peer (P2P) vitality buying and selling and clever contracts to environmentally friendly vitality provenance and methods interoperability.

In truth, a Global Blockchain in Power Sector research doc states blockchain engineering in the power business is about to report explosive advancement over the following five a long time with blockchain energy startups such as Power Ledger, WePower, UAB, and LO3 Energy set to open up up new opportunities for the electrical power marketplace, ranging from price tag-discounts for the client by getting rid of third parties in electricity deals and faster transaction settlements, all the way to the emergence of a new marketplace for peer-to-peer and surplus renewable energy trading.

By Alex Kimani for Oilprice.com

A lot more Best Reads From Oilprice.com: