Businessloans.com Review 2023 | businessnewsdaily.com

BusinessLoans.com Editor’s Score: 92/100

| Details | Rating |

|---|---|

| Collateral | 70 |

| Online application | 100 |

| Quick funding | 90 |

| Credit requirements | 100 |

| Variety of loan types | 100 |

Why BusinesssLoans.com Is Best for Comparing Loan Options

BusinessLoans.com uses 13 of your most basic data points to recommend high-quality loans that could work for your business. These data points are all you need to get started; BusinessLoans.com will educate you on the rest. The company’s website includes 101-level information on four key business loan categories, all of which it offers. Beyond that, the brand’s in-depth guides can introduce you to each loan type at greater depth.

Similarly, after you apply for a loan through BusinessLoans.com, you’ll hear from a company representative, who will guide you through choosing the right loan. The company also collects information from each of the roughly three dozen lenders in its network on why it approves or denies loans. It does this for each and every loan decision. This dovetails with BusinessLoans.com’s mission to find loans for everyone who fills out an application, even if they fall short of certain qualification criteria.

In short, BusinessLoans.com isn’t just an easy way to compare and learn about loans with expert help. It’s also a system that’s constantly improving its recommendations.

Pros

- The BusinessLoans.com application is simple and quick.

- BusinessLoans.com pairs you with a representative who will guide you through choosing the right loan and educate you on your options.

- BusinessLoans.com tries to work with anyone who applies, including borrowers who might not actually meet its qualifications.

Cons

- For some BusinessLoans.com loans, the time between applying for a loan and receiving your funding is one week, which is long compared to some competitors we reviewed.

- Many BusinessLoans.com loans require collateral.

- The BusinessLoans.com website isn’t the most transparent on loan terms and customer service.

Borrowing Costs

BusinessLoans.com borrowing costs depend on the exact loan and lender. The company is willing to work with just about any borrower, though, as is often the case, low-credit borrowers may pay higher interest rates. It is not entirely clear if certain lenders within the BusinessLoans.com do or don’t charge additional costs such as documentation fees and origination fees. Information on prepayment penalties or a lack thereof is also scant.

Once you sign up for a loan, you’ll arrange a repayment plan with your lender. For short-term and long-term loans, monthly payments will be due. Lines of credit work differently. You’ll pay interest only on the funding you actually use, and repayment may be possible more frequently than monthly. Merchant cash advances (MCAs) will require payment directly from your credit card sales or incoming cash, with exact terms varying by lender.

Applying for a Loan

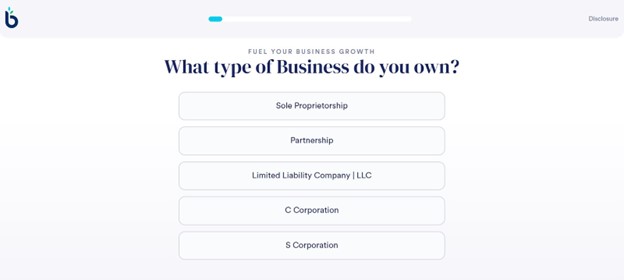

To apply for a loan with BusinessLoans.com, you’ll fill out a simple online application that takes no more than three minutes to complete. You’ll provide information on 13 data points that BusinessLoans.com uses to find the right lender for you. This data includes your business’s legal structure and your target loan amount, use of loan proceeds, time in business, annual revenue and credit score range.

From there, the BusinessLoans.com algorithm will match you with whichever of the company’s lending partners is best for your needs. The company works with over 35 lenders, so your likelihood of finding a lender who can meet your needs is pretty high. Once you get through the application process, a company representative will contact you to assist you with choosing the right loan.

This lender-matching model is similar to two other lenders we like a lot: Noble Funding and Biz2Credit. However, Noble Funding’s annual revenue threshold is orders of magnitude higher, blocking new business owners from working with this lender. Biz2Credit is also geared toward business owners who are already familiar with loans, which may not always be true of newer business owners. We like that BusinessLoans.com uses its extensive network to make business lending work for just about any customer.

Did you know?: If you want to compare other marketplace lenders to BusinessLoans.com, we’ve reviewed two great choices that may suit your needs. Read our Noble Funding review and our Biz2Credit review to find out if these options may be right for you.

Did you know?: If you want to compare other marketplace lenders to BusinessLoans.com, we’ve reviewed two great choices that may suit your needs. Read our Noble Funding review and our Biz2Credit review to find out if these options may be right for you.

The minimum annual income threshold to apply for funding through BusinessLoans.com is $100,000, which is relatively low. The minimum time in business can be as low as one month for some loans but is often six months. However, a BusinessLoans.com representative told us that the company tries to work with every borrower that completes its application. Thus, it may be worth applying even if you don’t match these criteria.

Similarly, there’s no minimum credit score requirement to apply for loans through BusinessLoans.com. This is a rarity in the business lending space. Most of our top business lender picks set a credit score minimum, even when the requirements are lenient. BusinessLoans.com makes applying for a loan and comparing your options easier than it is with any other lender we reviewed.

The BusinessLoans.com application process is straightforward and involves only easy questions. Source: BusinessLoans.com

Loan Types

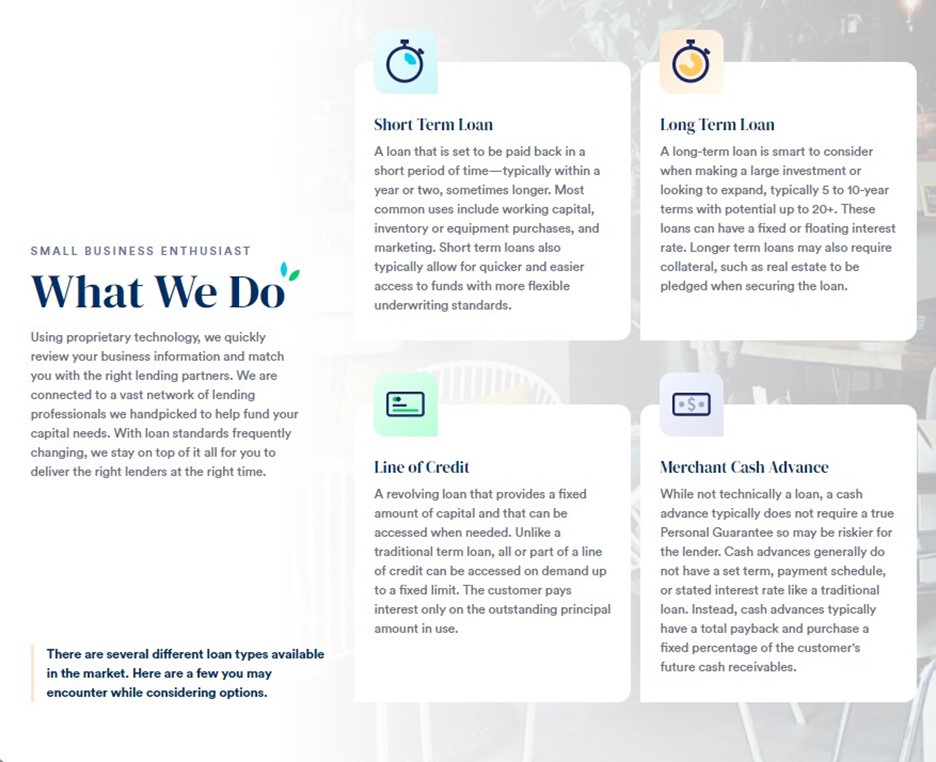

BusinessLoans.com offers four types of loans, all of which are major loan product categories. We like that BusinessLoans.com offers four major categories, instead of just one or two and a less familiar alternative product, like many competitors do.

- Short-term loans: You can use these BusinessLoans.com loans for inventory, marketing, equipment and working capital.

- Long-term loans: These loans through BusinessLoans.com may have fixed or variable rates. They may also require business collateral, which isn’t the case with competitor SBG Funding’s long-term options. Read our SBG Funding review to learn why this lender is our top pick for flexibility.

- Lines of credit: With this type of loan, you can borrow as much money (up to a fixed maximum) as you need, as often as you need. You’ll pay interest only on the funds you actually use.

- Merchant cash advance: This form of funding lacks repayment periods and repayment schedules. Instead, you’ll regularly send the lender a set percentage of your incoming cash or credit card sales. Notably, this type of funding might not require a personal guarantee if you obtain it through BusinessLoans.com.

Loan Terms

Most short-term loans through BusinessLoans.com come with repayment periods of one or two years. Long-term loans typically come with five- to 10-year repayment periods, though occasionally the repayment period can be 20 years.

It is unclear how long repayment periods are for BusinessLoans.com lines of credit or MCAs. The company’s website lacks information on this and other terms, perhaps due to the “matchmaker” model involving over 35 lenders. This is disappointing but not a deal-breaker, as the company has a strong reputation for transparency after you apply.

As for loan amounts, a BusinessLoans.com representative told us that loan sizes range from $5,000 to $3 million. We were also told that the company can occasionally find lenders that can offer even more funding.

Whether you’ll need to put up collateral or sign a personal guarantee depends on the lender with which BusinessLoans.com connects you. A personal guarantee may be more likely with this lender, whereas competitor Fora Financial doesn’t require one. Similarly, your exact repayment periods, repayment schedules and interest rates will vary by lender. A BusinessLoans.com representative told us that its credit line interest rates start at 3.5{60d48124524c163d93bcaf9d238c122260f539381ea62c0bffb11c8cd8c23591} and its term loan rates start at 9{60d48124524c163d93bcaf9d238c122260f539381ea62c0bffb11c8cd8c23591}.

Your timeline from application to funding will also vary by lender. This period may range from 24 hours to one week. The low end of this range is the same as with other lenders, but the high end is significantly longer than with many competitors. For example, the funding timeline for Fora Financial, our top pick for short-term loans, is 24 to 48 hours. That said, for business owners who aren’t familiar with loans, a slower decision-making approach can lead to smarter choices.

Tip: Looking for short-term loans without the need for a personal guarantee? Read our Fora Financial review to learn why this lender is our top pick for short-term loans.

Tip: Looking for short-term loans without the need for a personal guarantee? Read our Fora Financial review to learn why this lender is our top pick for short-term loans.

Helpful Tips

BusinessLoans.com doesn’t explicitly state the paperwork and documentation you must provide to obtain funding. This is presumably because requirements vary by lender. However, you can safely assume most lenders will ask for several recent business bank statements, tax returns and additional paperwork proving your business ownership. A business plan may also be necessary.

BusinessLoans.com offers several guides to common types of term loans, and reading these guides is a great way to further compare your choices. The BusinessLoans.com blog can also be a useful resource, though at the moment, it includes content about invoice financing only. Interestingly, invoice financing isn’t listed as an option on the BusinessLoans.com homepage. However, a company representative told us that BusinessLoans.com plans to add more content to its blog in the near future. This content may wind up reflecting the lender’s actual offerings.

BusinessLoans.com features

| Simple application | You can fill out the BusinessLoans.com application in about three minutes with your basic information. |

|---|---|

| Variety of loan types | You can obtain short-term loans, long-term loans, lines of credit and merchant cash advances through BusinessLoans.com. |

| Likely approval | BusinessLoans.com tries to match you with a loan even if you don’t meet key qualification criteria. |

Simple Application

The 13 data points you’ll need to provide for the BusinessLoans.com application are things you’ll likely know offhand. You’ll need no more than three minutes to complete and submit the form. This speed is ever so slightly faster than it is with many of our other picks for the best business loans.

Variety of Loan Types

You can obtain loan products within four major categories through BusinessLoans.com. These categories are short-term loans, long-term loans, lines of credit and MCAs. Not every top lender offers all these widely sought-after types of loans, making BusinessLoans.com a great pick for just about any borrower. In fact, a company representative told us that 55{60d48124524c163d93bcaf9d238c122260f539381ea62c0bffb11c8cd8c23591} of borrowers whom BusinessLoans.com funds return for a second loan.

Likely Approval

BusinessLoans.com does its best to match every borrower who applies for a loan with funding that works for them. In conversations with the company, it was clear that there’s wiggle room with the minimum-annual-revenue and time-in-business requirements.

On top of that, BusinessLoans.com requires that the lenders in its network share their reasoning for approving or denying borrowers each and every time. With this information, the BusinessLoans.com algorithm can make better matching decisions. Key criteria the lenders must share include the reason for declining loans, the amount and rate for approved loans, and whether the borrower obtained funding.

BusinessLoans.com offers a variety of loan types. Source: BusinessLoans.com

Customer Service

Unlike most other lenders we reviewed, BusinessLoans.com lacks both a clear customer service phone number and email address. It also lacks clear information on its customer service operating hours. While we were tempted to ascribe this to BusinessLoans.com’s borrower-lender matching model, Biz2Credit operates on a similar model and clearly lists its contact information.

However, there are plenty of indicators that BusinessLoans.com does provide excellent customer service. For starters, the company’s TrustPilot rating is 4.8 out of 5 stars across 57 reviews. Though this number of reviews may seem low compared to Biz2Credit’s more than 14,000 reviews, BusinessLoans.com has been in business only since 2020. Additionally, 98{60d48124524c163d93bcaf9d238c122260f539381ea62c0bffb11c8cd8c23591} of BusinessLoans.com’s reviews are five-star reviews, and the remaining 2{60d48124524c163d93bcaf9d238c122260f539381ea62c0bffb11c8cd8c23591} are four-star reviews.

Furthermore, BusinessLoans.com obtained Better Business Bureau (BBB) accreditation in May 2022. Its BBB rating is an A, which is on par with the A+ the BBB has given to Noble Funding, SBG Funding and Fora Financial. This rating is impressive for a company that’s been in existence only since 2020. It’s also an order of magnitude superior to Biz2Credit, which has a D rating with the BBB and a barrage of highly negative reviews.

Drawbacks

The most obvious drawback to using BusinessLoans.com is that you could have to wait a week to obtain your loan funding. Many of our other top business lender picks can deliver funding within, at most, two or three days. That said, BusinessLoans.com can fund your loan within 24 hours, as can other lenders. It’s just the high end of its funding timeline range that we found to be a drawback.

Additionally, BusinessLoans.com loans often require collateral, which isn’t true of some of our other best picks for business lenders. This may pose roadblocks for borrowers lacking the assets to secure a high-value loan. Personal guarantees may also be required, though perhaps not for merchant cash advances.

If you’re looking for information about your loan before – not just after – you apply for it, BusinessLoans.com might not be the lender for you. The company’s website doesn’t state its loan amounts and interest rates. Additionally, information about BusinessLoans.com’s loan terms is available for short- and long-term loans only. However, you’ll get all the information you need after you apply, and the company’s strong customer reviews and BBB accreditation indicate transparency.

Methodology

To find the best lender for comparing loans, we researched lenders that fund loans through third parties rather than in-house. We assessed the audiences these lenders target as well as their tools and personalized services for comparing and contrasting loan options. BusinessLoans.com emerged as our top pick given its dedication to helping any borrower find the right loan. The company’s online resources and concierge-style assistance in choosing the best available loan options can guide any borrower toward the right decision.

BusinessLoans.com FAQs

What is BusinessLoans.com?

BusinessLoans.com is a borrower-lender matching service launched in 2020. It is a joint effort among a group of investors, entrepreneurs and bankers to create a lending experience that prioritizes the borrower over the lender.

Is BusinessLoans.com a direct lender?

No, BusinessLoans.com is not a direct lender. Instead, it works with over 35 third-party lenders to match borrowers with the loans best for them.

Is BusinessLoans.com legitimate?

Yes, BusinessLoans.com is legitimate. It has an A rating from the Better Business Bureau as well as accreditation, and its nearly 60 TrustPilot reviews are highly positive.

Overall Value

We recommend BusinessLoans.com for …

- Business owners who need funding but lack familiarity with business lending terminology and processes.

- Business owners in need of caring, expert assistance in finding and choosing the best loan.

- Business owners who are struggling to qualify for loans from other lenders.

We don’t recommend BusinessLoans.com for …

- Business owners who don’t want to put up collateral to obtain a loan.

- Business owners who need a guarantee that their funding will arrive within well under a week.

- Business owners who like to read over loan terms, amounts and rates on a lender’s website before working with them.